Note on the COVID-19 Pandemic and Travel Insurance: According to InsureMyTrip, you will need to purchase a plan that includes Cancel For Any Reason if you are concerned about coronavirus. All travelers do not qualify so please read plan details carefully before purchasing travel insurance.

If you’re thinking about taking a trip, travel insurance can be a great way to protect yourself. This kind of insurance gives travelers a way to get their money back in the event their plans are canceled or interrupted.

The uncertainty surrounding travel amid the COVID-19 pandemic has only added to the importance of determining what kind of policy to buy. But there’s also the question of whether you need to buy travel insurance at all.

In general, insurance will cover only what is explicitly expressed in the policy. Many policies exclude pandemics and epidemics, so you need to do your research carefully.

Travel Insurance: Everything You Need to Know

This article covers the basics of travel insurance: when to buy it, where to buy it and how to make sure it covers your particular circumstances.

I got some expert advice from money expert Clark Howard. I also talked to a representative from InsureMyTrip, a travel insurance comparison site, to find out about “cancel for any reason” policies.

Clark once owned his own travel agency, and he thinks nearly everyone should consider buying travel insurance.

“I never like for people to buy narrow insurance; that’s why I advise people not to buy appliance warranties. Trip insurance is an exception and the reason why is because trips can be incredibly expensive and fully non-refundable.”

Let’s get into some questions and answers about travel insurance.

Quick Links

- What Is Travel Insurance?

- When Do You Need Travel Insurance?

- What Does Travel Insurance Cover?

- How Much Does Travel Insurance Cost?

- Where Should You Buy Travel Insurance?

- When Do You Need a Cancel for Any Reason Policy?

- Do You Also Need Travel Medical Insurance?

1. What Is Travel Insurance?

Travel insurance provides a full or partial refund in the case of illness or death of a member of the traveling party or close relative.

It can also provide coverage if a cruise, tour operator or airline defaults and in several other cases, depending on the policy.

2. When Do You Need Travel Insurance?

Clark thinks you should consider travel insurance a conditional expense: You don’t need it for all types of travel.

But he says you do need it if you’re:

- Taking a cruise

- Booking special tours as part of your trip

- Traveling on an itinerary that requires prepayment of thousands of dollars

“If you book a tour or you book a cruise — those two in particular — if you’re going to lose all your money regardless of why you can’t come, then you need to get insurance,” Clark says.

Clark says you probably don’t need travel insurance when:

- Your trip consists of flights and hotel stays that are fully refundable.

- The cost of making changes to your itinerary is less than it would cost to re-book your trip.

3. What Does Travel Insurance Cover?

The website Cover Trip lays out some of the most common things covered by travel insurance, including:

- Injury or illness of policyholder, travel companion, family member or business partner

- Hurricane or natural disaster

- Bankruptcy or financial default of travel company

- Terrorism or mandatory evacuation

- Death or hospitalization of destination host

- Jury duty, a required court appearance, or military redeployment

- Victim of felonious assault prior to trip

- Traffic accident prior to trip

- Theft of passport or visa prior to trip

- Legal separation or divorce

- Loss of accommodations abroad due to an illness or death of host family or friends

- Trip cancellation coverage

- Emergency evacuation

- Travel assistance benefits

- Coverage for medical expenses

But there is a wide range of types of travel policies and coverage, so be sure to check the fine print of any policy you are considering before you buy it.

4. How Much Does Travel Insurance Cost?

Travel insurance policies generally cost anywhere between 4-10% of the price of the total trip.

For example, if you are booking a trip that costs a total of $2,000, you can expect to pay around $80-$200 for a travel insurance policy.

But this is important: Never purchase the travel protection plan from the trip organizer or online travel agent. They are designed to protect the company and not the consumer, Clark says. This includes travel booking sites such as Expedia and Travelocity.

5. Where Should You Get Travel Insurance?

If you’re not supposed to buy travel insurance coverage from the place where you book the trip, where do you go?

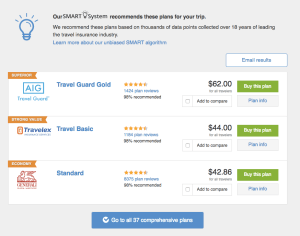

Clark recommends that you comparison shop for the best travel insurance that suits your needs at InsureMyTrip.

“The reason I like InsureMyTrip is because it’s like an aggregation service or comparison site, and you can see all the different choices available,” he says.

InsureMyTrip’s quote process also has a recommendation tool that guides travelers toward plans best equipped to protect against COVID-related travel issues.

When you visit InsureMyTrip, you’ll be asked for the following information:

- Destination country

- Dates of travel

- Traveler citizenship

- Traveler age and residence information

- Trip details (flights, hotels, accommodations, etc.)

The site will then recommend travel insurance plans for you and show you the cost, plan details and consumer ratings for each travel insurance company. You can read more about InsureMyTrip in our full review of the service.

You can compare the available plans and select the one that best suits your needs.

In addition, Clark says, “There are a number of travel credit cards that include travel insurance with them if you use them to buy the travel.”

Typically, coverage from these cards is less comprehensive than what you’ll find in plans from InsureMyTrip, so make sure you’re comfortable with that before you decide to rely solely on coverage provided by your credit card.

6. When Do You Need a “Cancel for Any Reason” Policy?

A “cancel for any reason policy” (CFAR) allows you to cancel your travel plans for any reason and still get some of your money back.

Clark says this option is typically considered an upgrade to standard travel insurance coverage, so it costs a little more. However, you should know that it won’t usually cover the full cost of your trip.

A CFAR policy “gives about 50-75% of that trip cost back, depending on the plan you purchase,” says Ronni Kenoian, manager of marketing and e-commerce for InsureMyTrip. To be eligible for CFAR coverage, Kenoian says you’ll need to insure 100% of your prepaid non-refundable costs.

Here are three key things to know about a cancel for any reason policy:

Cancel for Any Reason Is a Time-Specific Benefit

A CFAR policy is typically available only in the first 10-21 days after you make your first payment on your travel arrangements, according to Kenoian.

CFAR Is Now Available in New York State

New York was the only state that banned CFAR policies. But in March 2020, Gov. Andrew Cuomo announced a change in state insurance regulations. Because of the pandemic, New York residents can now buy CFAR insurance even if that reason is the pandemic.

Check With Your Airline, Tour Operator or Cruise Line Before You Buy

“A lot of travel suppliers are taking [current events] into consideration,” Kenoian says, “so travelers need to contact them first, because you might not need to use travel insurance.”

“Generally, we know that people are scared, but they need to know that they do have options,” Kenoian says. “We’re asking them to please call their travel suppliers if they’ve already booked the trip to see what kinds of benefits they are being offered.”

Clark.com Travel Editor Clara Bosonetto also recommends calling the issuer of the credit card on which you booked your travel to see if it offers any refund options.

7. Do You Also Need Travel Medical Insurance?

Most travel insurance policies include some form of medical insurance and medical evacuation insurance. But it’s important to read the fine print to see that coverage alone will be sufficient if you have a medical emergency on your trip.

The Center for Disease Control and Prevention puts the cost of medical evacuation in excess of $100,000. If you’re traveling to a developing country, you might consider this kind of policy as a hedge against the possibility of a huge medical bill if you need to be taken somewhere that has better medical facilities.

Final Thought

Travel insurance generally reimburses you if your trip is interrupted or canceled for a variety of reasons typically considered to be outside of your control.

Clara points out that standard travel insurance probably won’t cover you if you want to cancel because of a travel advisory or just because you’re afraid to travel.

“Additionally, the uncertainty of a medical outbreak is not a claim covered by policies,” she says. “And some policies specifically exclude pandemics.”

Given these realities, the bottom line with travel insurance is that you really need to do your homework. That means taking time to go over different policies to find one that fits your needs.

Here are the two key steps you should take before purchasing travel insurance:

- Check with your trip provider to find out about its refund/rebooking policies related to the pandemic.

- Even if you shop for a travel policy online, talk with an insurance representative by phone to get your specific questions answered.

Planning for a trip overseas? Learn more about travel medical insurance here.

Best Travel Credit Cards: Top Rewards Picks for 2023 - The best travel rewards credit cards! Compare the latest sign-up bonus offers to start earning free flights, hotel stays and more.

Best Travel Credit Cards: Top Rewards Picks for 2023 - The best travel rewards credit cards! Compare the latest sign-up bonus offers to start earning free flights, hotel stays and more.